Cost and Features to Build...

July 17, 2025

Introducing Artificial intelligence (AI) has been credited to have caused a drastic change in the face of a number of industries including the banking sector. Overall, the application of AI technology has not only improved the efficiency of banking operations with regard to consumers’ demands and trends. It has led to increased customer services, convenience, and a deformity in the operation efficiency of the banking industry.

However, while the opportunities are great, the route toward the use of AI in banking is fraught with issues. Some of these are technological while others are more of social issues, such as privacy and data protection issues.

Here in this blog, let’s understand how AI is valuable; what are the new customer experiences AI is bringing to banking, and what challenges banks encounter while transitioning to AI operations. As this extensive discussion will demonstrate, the application of AI extends beyond simple mechanization and becomes a disruptive force that is reinventing the fundamentals of banking.

Artificial intelligence commonly referred to as AI is fast on its way to becoming an essential commodity in the banking industry and is a key driver of change that will transform the sector in terms of performance. In this case, the use of AI is not only an advantage over other banks but is becoming one of the strategic fundamentals for activities in today’s fast-changing financial services environment.

The relationship between AI and the banking sector is one of the most promising and revolutionary in terms of effectiveness. It remolds the relationships between the financial institutions and the consumers, risks, and services provided, therefore, is approaching the change of a traditional banking system.

Also Read: Choose the Right AI Model for Your Business: Decoding AI

These trends illustrate AI’s critical role in driving forward the banking industry, ensuring institutions not only stay competitive but also redefine their service paradigms in the face of digital transformation.

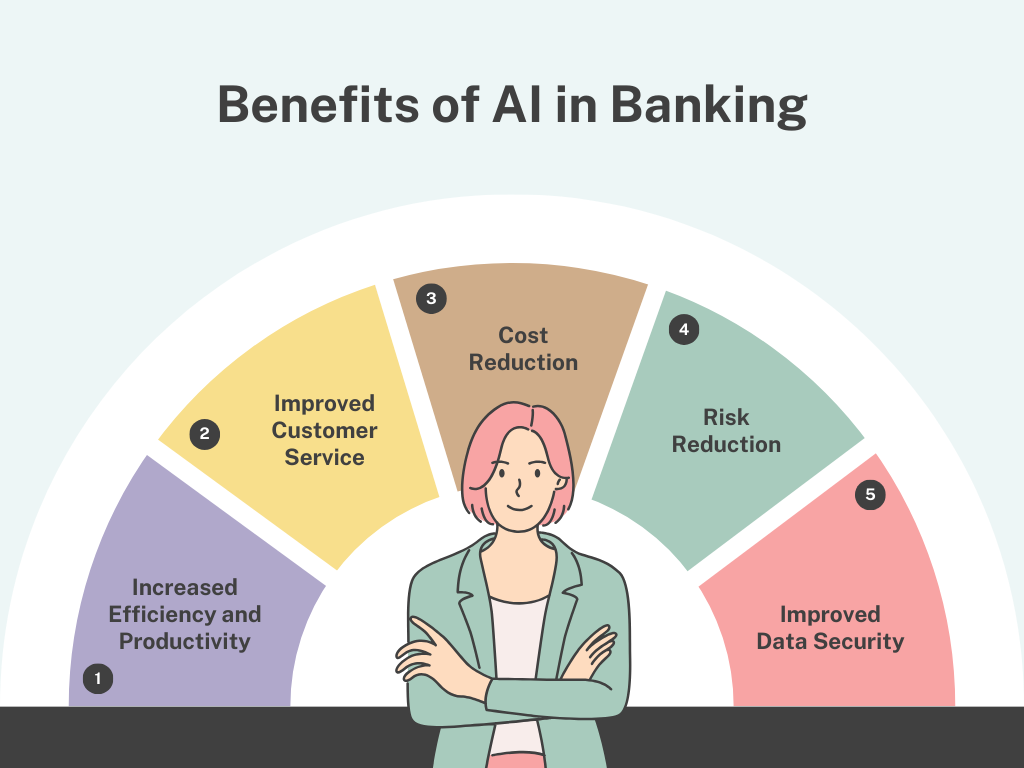

Banking is a domain that has been changed by Artificial Intelligence (AI), and this is evident from the fact that it is changing the ways that operations are carried out, customer satisfaction and security are offered in a very dynamic way. Here are the key benefits of implementing AI in banking:

AI enhances process efficiency because it eliminates tiring and repetitive tasks that are repetitively performed in organizations. Not only does this increase productivity, but it also frees bank staff to work on more important and challenging tasks, thereby improving the extent of the contribution made to value-added tasks.

AI technologies, like chatbots and virtual assistants, provide round-the-clock customer service, offering immediate responses and personalized assistance. This capability improves customer engagement and satisfaction by delivering a seamless and efficient service experience.

This eliminates the difficulty and costs of Manual operation, as AI automates multiple processes involved in Operational execution. It promulgates banking services’ automation across numerous spheres, be it customer relations or post-purchase operations, so that resource provision remains effective and overhead costs minimal.

AI enhances risk management in banking by providing sophisticated tools for fraud detection, credit risk assessment, and regulatory compliance monitoring. By analyzing vast amounts of data, AI systems can identify patterns and anomalies that might indicate fraudulent activity or potential risks, enabling proactive management and mitigation.

In an era where data breaches are costly and damaging, AI contributes substantially to the security infrastructure of banking institutions. AI-driven systems continuously monitor and analyze transactions and user behaviors to detect and respond to threats in real-time, thereby safeguarding sensitive financial information.

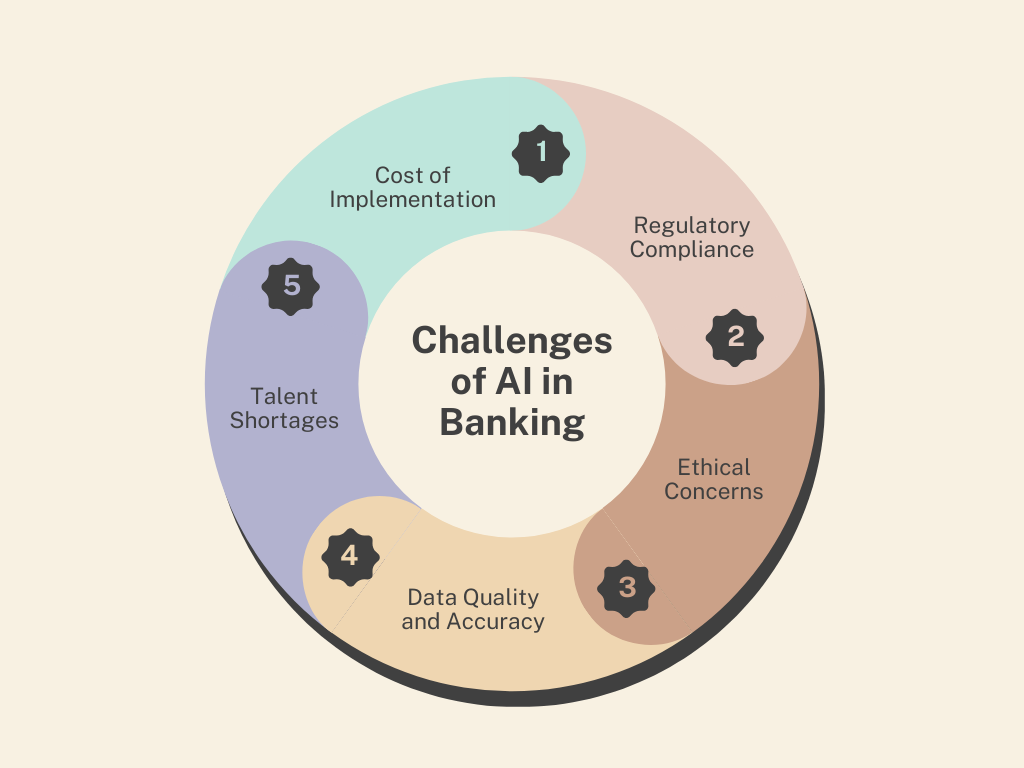

There are several crucial challenges that the banking sector faces as it adopts AI while pursuing the noble aim of making the best out of it. Here are some of the key challenges associated with AI in banking:

Measuring the cost-benefit of implementing AI in banking it is agreeable that the cost involved in the initial stage of implementing AI is relatively high since the new course comes with new structures, change of systems, and new human resources mostly technology specialists. These costs should be adequately estimated and evaluated against the benefits that the bank would be enjoying in the future from the investment.

AI has to be legalistic, it has to follow laws that comprise GDPR or other financial laws that govern the market. It is sometimes difficult to make sure that the AI systems that the company uses adhere to these regulations; however, it is critical to do so to avoid legal repercussions and customer distrust.

The deployment of AI in banking raises important ethical issues, particularly concerning bias and discrimination in algorithmic decision-making. To address these concerns, banks must develop and adhere to stringent guidelines that promote fairness, transparency, and accountability in their AI applications.

The effectiveness of AI depends heavily on the quality of data it processes. Inconsistencies, incompleteness, or errors in data can lead to inaccurate outputs and decisions. Therefore, banks must invest in robust data management systems to ensure their AI tools have access to clean, accurate, and comprehensive data sets.

There is high competition for such jobs since there exists a high demand for skilled AI and data science professionals in the banking industry. One of the major issues is difficulty in recruiting and retaining AI talent, and another one is training the existing workforce to work in synergy with these AI systems.

Also Read: The Best Programming Languages for AI Development in 2024

Read More: Mobile Banking App Development Cost in 2024

Inexture Solutions can come to your assistance and make the path to AI in banking even smoother and quicker with a solid foundation that we will develop for you. Our service offerings include providing advice and instructions on the integration and use of artificial intelligence based on the goals and modalities of the bank. First, we engage with your team to understand which problems, opportunities, and challenges might benefit from AI most significantly, for example, enhanced CX, fraud identification, risk mitigation, and process optimization.

Our plan entails studying how we can incorporate AI technologies into your current systems to ensure new integration does not interfere with ongoing operations. It also focuses on compliance and ethical concerns in all the products that it offers to make sure that it adheres to conventional standards in this type of technology.

Additionally, our team is comprised of highly skilled professionals in data processing and algorithm development which is imperative to reliable and precise AI solutions. It does not end with implementation because the whole purpose, again, as I have mentioned earlier is about creating value for customers through innovative operative models and managerial interventions.

Besides, we provide constant support and education focusing on providing your staff with guidance on how to manage and implement AI products effectively. This is done through assumptions of new and advanced AI models with the incorporation of cutting-edge AI technologies in response to data flows received and dynamic market environment to ensure your bank keeps on affording modern and enhanced banking products.

Working with Inexture means not only embracing the latest in banking technology but also bringing on board an innovative solution provider who will help your bank transform and leap toward the future of digital financial services.